Protect Your Salon: Understanding the Importance of Cosmetology Liability Insurance

In the beauty industry, liability is an ever-present concern for salon owners and cosmetologists. With daily services that directly affect clients’ skin, hair, and overall appearance, there is a significant risk of something going wrong, whether it’s an allergic reaction to a product or an accidental injury. For this reason, having comprehensive protection through liability insurance is not just a smart decision but a critical one.

From slip-and-fall accidents to adverse reactions to chemical treatments, the potential risks in a salon setting are numerous and often unforeseen. These incidents can lead to costly legal battles, medical expenses, or reputational damage, all of which can negatively impact your business. Without the right coverage, you could find yourself facing financial ruin. Engaging with a legal money lender Singapore offers a seamless borrowing experience. They prioritize customer satisfaction through flexible loan packages, helping individuals and businesses bridge financial gaps safely.

In this blog post, we will explore why cosmetology liability insurance is essential for safeguarding your business and how it can protect you from the unexpected, allowing you to focus on what you do best—providing exceptional beauty services to your clients.

What is Cosmetology Liability Insurance?

Cosmetology liability insurance is designed to protect salon owners and beauty professionals from various risks associated with running a salon or providing beauty services. This type of insurance covers claims related to accidents, injuries, or damage caused during the course of business. It ensures that cosmetologists can operate with peace of mind, knowing they are financially protected from potential lawsuits and compensation claims.

1 – General Liability Insurance

General liability insurance is a key component of cosmetology liability coverage. It protects against claims arising from accidents and injuries that occur on your salon premises. For example, if a client slips on a wet floor and sustains an injury, or if a piece of salon equipment accidentally causes damage, general liability insurance steps in to cover medical costs, legal fees, and any compensation required. Without this coverage, salon owners may be held personally responsible for the financial fallout of such incidents, making general liability insurance a crucial safeguard for any beauty business.

2 – Professional Liability Insurance (Also Known as Malpractice Insurance)

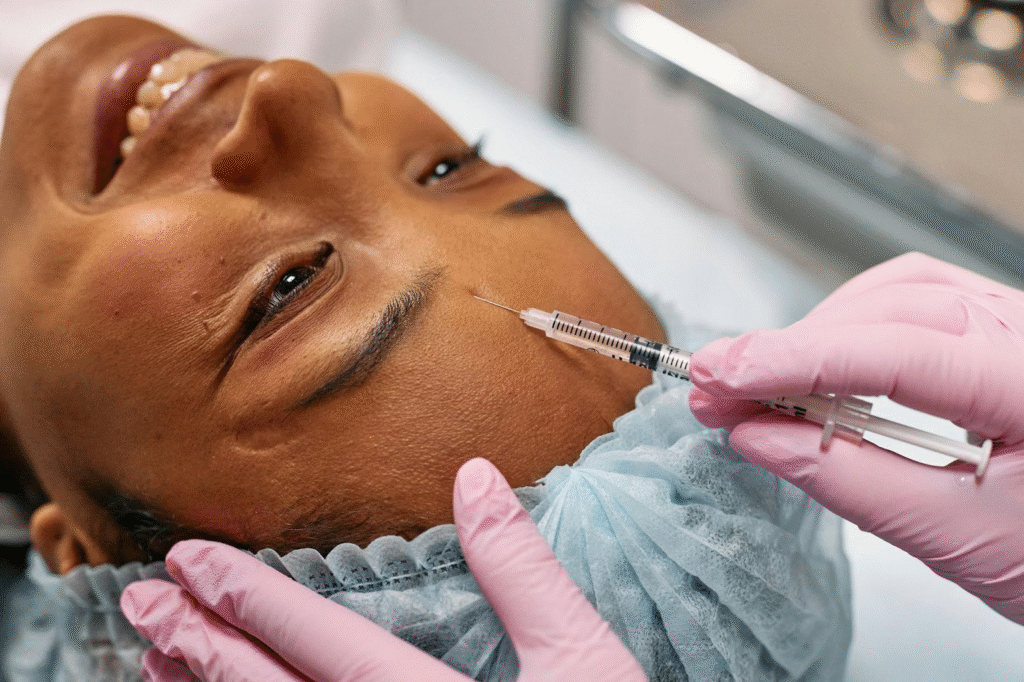

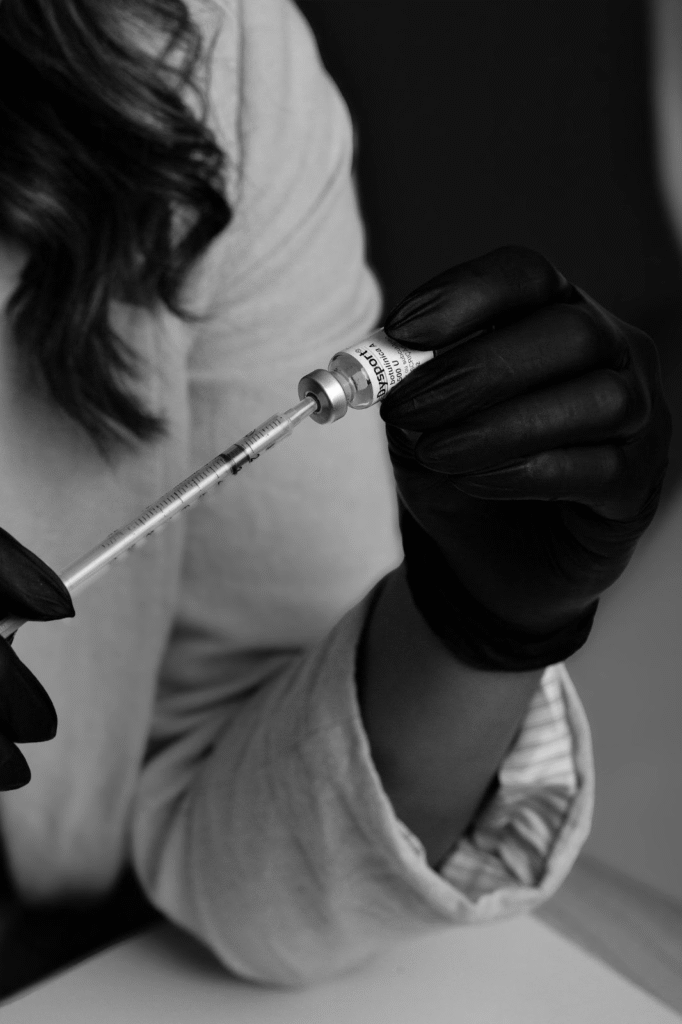

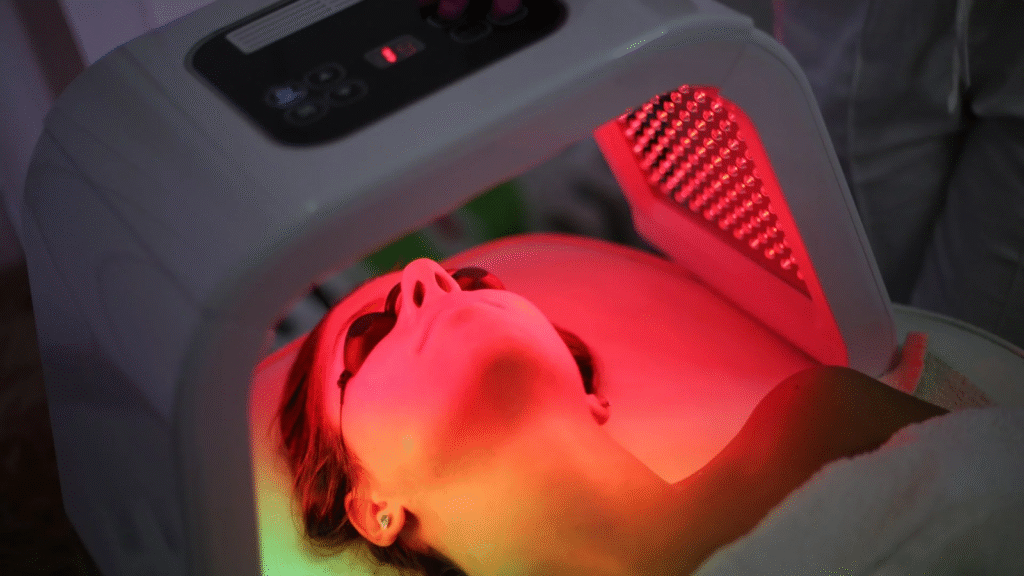

Professional liability insurance, often referred to as malpractice insurance, covers claims related to the services cosmetologists provide. This includes situations where a treatment goes wrong, causing harm or dissatisfaction to the client. For instance, if a hair coloring treatment results in a severe allergic reaction or if a client is unhappy with the outcome of a cosmetic procedure, professional liability insurance protects the cosmetologist from being held financially liable for the consequences. It covers legal defense costs, settlements, and any compensation owed to the affected client, allowing beauty professionals to continue their work without the constant fear of legal repercussions.

3 – Product Liability Insurance for Cosmetologists

In a salon, the products you use and sell are just as important as the services you provide. Product liability insurance ensures that if a product causes harm to a client, you are covered. This could include allergic reactions to skincare products, damage from hair treatments, or issues with retail items sold in the salon. Product liability insurance protects against lawsuits and claims, ensuring that your business isn’t financially jeopardized due to defective or harmful products. Whether the product is used during a service or purchased by the client for home use, this type of coverage is critical for maintaining the trust and safety of your clientele.

Common Risks and Liabilities Faced by Salons

Salons, though spaces of creativity and beauty, are not without their risks. Every day, owners and cosmetologists face numerous potential liabilities that can lead to financial losses or legal trouble. From slip-and-fall accidents to client dissatisfaction and allergic reactions, it’s essential to be aware of these risks and take steps to protect your business. Let’s explore some of the most common liabilities salons face and how the right insurance coverage can mitigate these risks.

Accidents and Injuries

In a bustling salon, accidents are almost inevitable. For example, a client may slip on a wet floor after a hair wash or trip over electrical cords powering styling tools. Equipment like hot curling irons, hairdryers, or sharp scissors, if not handled properly, can also pose dangers. Imagine a scenario where a client accidentally gets burned by a styling tool left unattended or suffers a cut during a hair trimming session. These incidents can lead to serious injuries, requiring immediate medical attention and possibly resulting in legal claims against the salon.

Client Complaints and Lawsuits

No matter how skilled or experienced a cosmetologist may be, client dissatisfaction is a reality in the beauty industry. Sometimes, a haircut doesn’t turn out as expected, a hair dye job may not match the client’s vision, or a skincare treatment may not provide the desired results. While some clients may accept these disappointments, others could escalate the situation, filing a complaint or even a lawsuit if they believe they were wronged.

This coverage helps protect against claims that the services provided were substandard, even if the cosmetologist is not at fault. It can cover legal defense costs, settlements, or judgments, ensuring that a single client complaint doesn’t result in a financially crippling lawsuit.

Product Reactions and Allergies

Salons use an array of beauty products, ranging from hair color treatments to skincare lotions, nail polishes, and more. While these products are generally safe for most clients, there’s always the potential for an individual to experience an allergic reaction. A client may develop a rash, swelling, or more severe health complications after exposure to certain chemicals or ingredients found in beauty products.

With product liability insurance, salons can operate confidently, knowing that any claims related to adverse product reactions will be handled without impacting the business’s bottom line.

Employee-Related Incidents

Salon owners rely on their staff to deliver excellent services, but employees, like anyone else, are prone to making mistakes. An employee could accidentally injure a client during a service, such as applying a treatment incorrectly or using equipment in a way that causes harm. For example, a nail technician might use a tool improperly, leading to an injury, or a hair stylist could leave a chemical treatment on for too long, damaging a client’s hair.

Key Benefits of Cosmetology Liability Insurance

Cosmetology liability insurance offers a range of benefits that go beyond simple legal protection. It serves as a safety net for salon owners and beauty professionals, ensuring that they are financially and professionally secure in the face of potential risks. Let’s explore the key benefits of having liability insurance in the beauty industry.

Financial Protection Against Lawsuits

One of the most significant advantages of cosmetology liability insurance is the financial protection it provides against lawsuits and claims. Legal disputes can arise from a variety of situations, such as accidents in the salon, customer dissatisfaction with services, or even allergic reactions to products used. Without insurance, these lawsuits can lead to substantial legal fees, compensation costs, and settlement expenses, which could cripple a business financially.

Liability insurance covers these costs, preventing salon owners from having to dip into their personal savings or operational budget to pay for legal defense and potential damages. This means that in the event of a lawsuit, whether it’s a slip-and-fall accident or a professional negligence claim, the insurance will cover the financial fallout, ensuring that your business remains protected and solvent.

Safeguarding Your Reputation

In the beauty industry, reputation is everything. A single claim or lawsuit can tarnish a salon’s image and erode the trust that clients have in your services. However, having cosmetology liability insurance in place shows your commitment to professionalism and responsibility. When clients know that your business is insured, it can build their confidence in your ability to handle unforeseen situations with care and accountability.

Additionally, if an issue arises, your insurance can help you manage the situation in a way that minimizes negative publicity. By providing the resources to settle claims quickly and fairly, liability insurance allows you to resolve disputes without lengthy public legal battles, protecting your salon’s reputation in the process. Clients are more likely to continue trusting your business if they see that you take issues seriously and have systems in place to address them.

Peace of Mind for Salon Owners and Professionals

Running a salon is no easy task. Beyond delivering top-notch beauty services, you’re responsible for managing staff, maintaining equipment, and ensuring the safety and satisfaction of every client who walks through the door. With so many responsibilities, it’s easy to feel overwhelmed by the potential risks lurking in your daily operations.

Cosmetology liability insurance offers peace of mind by knowing that, should an unexpected incident occur, you’re protected from financial and legal hardships. Whether it’s a client suing over a service gone wrong or an employee-related mishap, your insurance acts as a safeguard, covering the costs and enabling you to focus on what truly matters—growing your business and providing excellent services. This assurance allows you to operate with confidence, knowing that your business is secure from unforeseen liabilities.

How to Choose the Right Cosmetology Liability Insurance

Selecting the right cosmetology liability insurance for your salon is an important step in protecting your business. However, not all insurance policies are created equal. It’s crucial to understand your salon’s unique needs and make informed decisions about coverage. Here are the key factors to consider when choosing liability insurance for your salon.

Assessing Your Salon’s Specific Needs

Before you start shopping for insurance, it’s essential to evaluate the specific risks and needs of your salon. The type of services you offer, the number of employees you have, and the size of your business all play a significant role in determining the type and amount of coverage you require.

- Services Offered: Different services come with varying levels of risk. For instance, salons that offer chemical treatments such as hair coloring or skin peels may face higher risks of adverse reactions or client injuries compared to salons that only offer haircuts. If your salon provides specialized treatments like laser hair removal or cosmetic tattooing, you may need more comprehensive coverage to protect against potential claims.

- Number of Employees: If you have a larger team of stylists, nail technicians, or estheticians, you’ll want to ensure your policy extends to cover employee-related incidents. Some policies only provide coverage for the owner and may not protect against claims involving staff. It’s important to choose a plan that adequately covers your entire workforce.

- Business Size and Clientele: A larger salon with higher foot traffic will likely face more risks than a smaller, boutique operation. Consider the size of your business and the number of clients you serve daily. If your salon has a significant customer base, the likelihood of incidents such as slips, falls, or customer complaints increases, and you’ll need a robust policy to manage these risks.

By thoroughly assessing your salon’s unique characteristics, you’ll be able to choose an insurance policy that provides the right level of protection for your business.

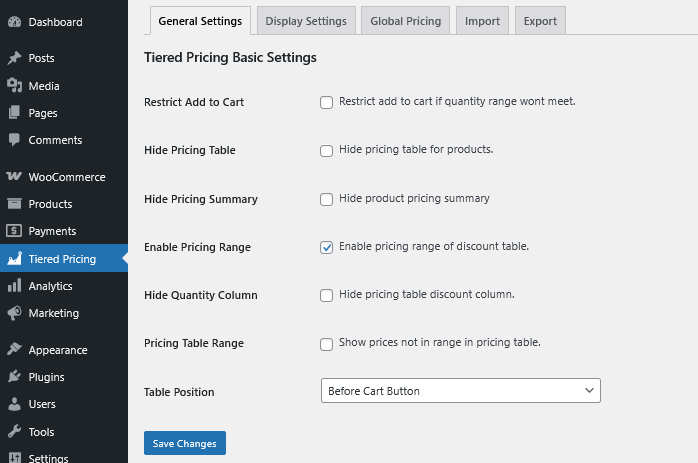

Comparing Insurance Providers

With many insurance providers offering liability coverage for salons, it can be overwhelming to find the best one. Here are some tips to help you compare different providers and select the right policy for your business:

- Cost: While price is a crucial factor, it shouldn’t be the only consideration. Make sure you compare not just the premium costs but also the value of the coverage. Cheaper policies may offer limited protection, which can leave you vulnerable to gaps in coverage.

- Coverage Options: Look at what’s included in each policy. Some providers offer basic liability insurance, while others include additional coverage for things like product liability or employee-related claims. Make sure the policy covers the specific services you offer and the risks your salon faces.

- Customer Reviews and Reputation: Do some research on each insurance provider’s reputation. Check customer reviews to see if other salon owners have had positive experiences with the company. Pay attention to feedback on claim handling, customer service, and the ease of purchasing and maintaining the policy. A provider with a good reputation for processing claims promptly and fairly is essential for your peace of mind.

- Specialized Providers: Consider whether the provider specializes in cosmetology or beauty industry insurance. Companies with experience in the industry are often more attuned to the specific needs of salon owners and may offer more tailored coverage options.

By comparing providers based on these factors, you’ll be better equipped to select a policy that offers comprehensive coverage at a reasonable price, backed by a provider you can trust.

What Happens If You Don’t Have Cosmetology Liability Insurance?

Operating a salon without cosmetology liability insurance can expose your business to significant risks. From unexpected lawsuits to costly claims, the lack of protection can lead to severe financial and operational challenges. Here’s what can happen if you don’t have cosmetology liability insurance.

Potential Financial Ruin

One of the most immediate and severe consequences of not having liability insurance is the risk of financial ruin. Without insurance, any legal claims or lawsuits brought against your salon—whether from a client injury, a service gone wrong, or a product-related issue—must be handled out of pocket. The costs associated with legal defense, court fees, and potential settlements can easily escalate into the tens or hundreds of thousands of dollars.

For example, a client may file a lawsuit after slipping on a wet floor, claiming medical expenses for their injury. Without general liability insurance to cover such incidents, you would be responsible for not only the legal defense costs but also any settlement or judgment awarded to the client.

Impact on Business Operations

Beyond the financial consequences, not having liability insurance can severely disrupt your business operations. Legal claims often require significant time, attention, and resources to resolve, pulling you away from the day-to-day management of your salon. Court appearances, meetings with lawyers, and managing the fallout of a claim can lead to lost productivity, fewer client appointments, and overall decreased revenue.

In more extreme cases, a lawsuit could lead to the temporary or permanent closure of your salon. If you can’t cover the costs of a claim or legal defense, you may be forced to shut down operations to prevent further financial damage. Even if your salon remains open during a lawsuit, the stress and distraction caused by dealing with legal matters can hinder your ability to deliver high-quality services and maintain staff morale.

Final Thoughts on Protecting Your Salon with Liability Insurance

Cosmetology liability insurance is an essential safeguard for salon owners and professionals, offering protection from the unexpected risks that come with running a beauty business. From client accidents to service-related claims and product reactions, the right insurance policy can protect your finances, reputation, and peace of mind. Without it, you expose your salon to potentially devastating lawsuits, financial ruin, and disruptions in daily operations.

By assessing your specific needs, comparing providers, and understanding coverage limits, you can choose the right insurance to secure your salon’s future. Investing in cosmetology liability insurance is not just about managing risks—it’s about ensuring your salon thrives, even in the face of challenges.