Identity Verification Checks Against Government Databases for Reliable Compliance

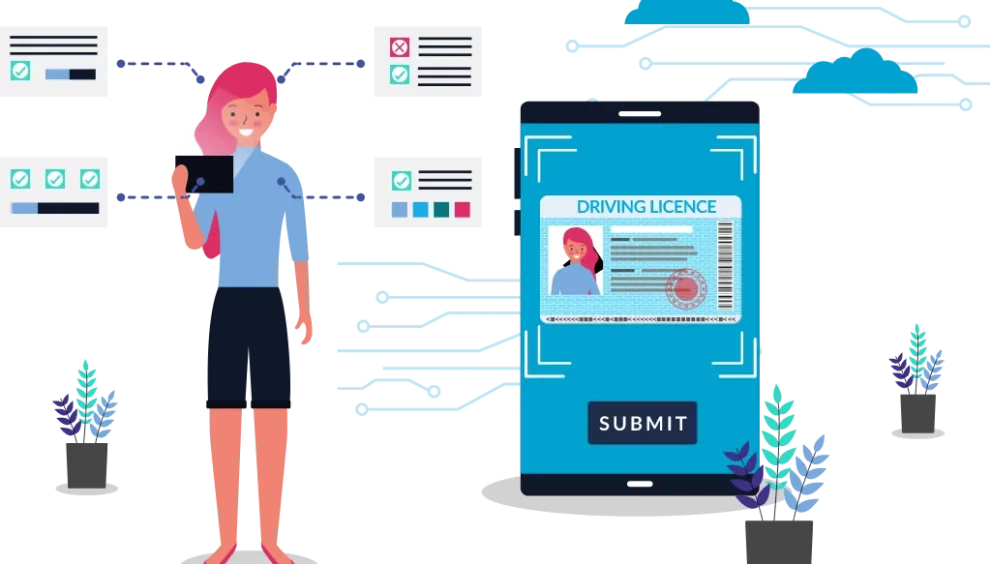

Identity verification plays a critical role in securing business operations and ensuring compliance with regulations across industries. Whether you operate in finance, healthcare, or e-commerce, maintaining trust and adhering to legal requirements necessitates accurate identity verification processes. One of the most effective ways businesses are achieving this is by identity verification checks against government databases and registries. These checks offer a powerful and reliable way to confirm customer identities, prevent fraud, and meet compliance standards with minimal friction.

Below, we take a closer look at the key benefits of using identity verification checks against government databases and why this trending approach is proving invaluable.

Streamlined Compliance with Regulatory Requirements

Government regulations designed to prevent identity fraud and ensure financial security often require businesses to implement thorough customer verification processes. This includes frameworks like Know Your Customer (KYC) and Anti-Money Laundering (AML) mandates. Identity verification checks against government databases simplify compliance with these requirements by directly matching customer data with verified records.

This reduces the administrative burden associated with compliance and ensures businesses can avoid costly penalties that come with non-adherence. By integrating this process, you create an automated pipeline for securing identities and meeting regulatory benchmarks.

Reduced Fraud and Enhanced Security

One of the primary purposes of identity verification is to ensure that people are who they claim to be. Fraudulent activity, such as identity theft, often costs businesses significant financial and reputational losses. Cross-referencing information against government databases provides an additional layer of security, ensuring that critical details like Social Security numbers or national ID numbers are legitimate.

Government databases are among the most accurate and up-to-date data repositories available, making them highly effective in identifying suspicious discrepancies. This enhanced accuracy discourages fraudsters from attempting to enter your system and protects both your business and customers from potential breaches.

Faster Onboarding Without Compromising Accuracy

Streamlined onboarding processes are vital in competitive industries where customer expectations for convenience are high. Traditional identity verification methods, such as manual document reviews or relying on physical submissions, can be time-consuming and frustrating for both customers and businesses.

Leveraging government database checks speeds up the onboarding process while ensuring high accuracy. Automating verification steps reduces the time required to approve applications, enabling businesses to onboard customers quickly without compromising due diligence. This faster process can lead to increased customer satisfaction, better operational efficiency, and higher engagement rates.

Improved Customer Experience

By integrating government database checks, businesses can offer seamless and frictionless experiences for their users. Customers no longer have to deal with lengthy manual verification or provide repeated documentation. Instead, their credentials are automatically verified against trusted sources, providing a smoother and less intrusive process.

This creates a positive impression of the business, building customer trust and increasing the likelihood of long-term engagement. A simplified process also reduces drop-off rates, as customers are less likely to abandon their registrations or transactions because of tedious verification requirements.

Enhanced Global Verification Capabilities

For businesses expanding into international markets, verifying customer identities across different countries can be challenging. Government database checks offer a scalable and reliable method for global verification, enabling businesses to operate confidently in multiple jurisdictions.

Many governments maintain records that include passport numbers, driving licenses, and national IDs, which can be cross-referenced regardless of location. This allows businesses to streamline their verification systems on a global scale, ensuring consistent compliance and security no matter where their customers are.

Cost-Efficient Verification Processes

Implementing identity verification against government databases offers significant cost savings compared to traditional verification methods. Manual reviews, staffing for compliance checks, and handling documentation often incur high costs, especially in organizations with a large customer base.

By turning to automated government database checks, businesses can reduce labor costs and minimize the resources required to maintain comprehensive verification procedures. This cost-efficient approach allows businesses to allocate their resources more effectively and focus on growing their core operations.

Real-Time Identity Confidence Levels

Identity verification that uses government database checks provides real-time validity of customer credentials. This immediacy is critical for industries such as finance, where quick decisions are often needed to prevent fraudulent transactions. Real-time checks give businesses confidence in the identities they are onboarding or interacting with, minimizing risks and ensuring secure interactions.

This feature becomes especially valuable in scenarios involving high-stakes verifications, such as loan approvals, access to sensitive data, or large-scale transactions. By having immediate confirmation of customer identity, businesses can operate with increased assurance.

Support for Automation and Advanced Technologies

The integration of government database checks aligns seamlessly with modern technologies, including artificial intelligence and machine learning systems. Through automation, businesses can create workflows that allow for instant verification and minimize human intervention. This leads to fewer errors and faster decision-making.

Additionally, these technologies can continue to evolve alongside the availability of government databases, further enhancing their efficacy over time. Businesses that adopt these systems early position themselves as cutting-edge organizations prepared to meet the challenges of tomorrow.

Simplified Audit Trails for Future Reference

Maintaining accurate records of every identity verification process is not only a regulatory requirement but also an essential best practice for businesses facing auditing or disputes. Using government database checks ensures thorough audit trails are created automatically.

These records are critical for demonstrating compliance with laws and regulations, and they also foster accountability by showing that verification processes were conducted transparently. Simplified audit trails also lend credibility to businesses in the eyes of regulators and stakeholders.

Scalable Solutions as Demands Evolve

Finally, one crucial benefit of government database checks is their scalability. Businesses grow, and so do their verification requirements. Whether you are dealing with a hundred customers or millions, an automated system leveraging government databases can adapt to handle increased demand without overwhelming your resources.

This scalability allows you to future-proof your identity verification processes, ensuring they remain effective even as business needs evolve. It also guarantees that customer experience and compliance standards are maintained without compromise.

Reliable identity verification has become a fundamental necessity in today’s digitally driven world. Integrating processes that check customer identities against government databases provides businesses with unparalleled accuracy, efficiency, and security. Beyond streamlining compliance and enhancing customer satisfaction, these methods prepare organizations to thrive in competitive and increasingly regulated industries.