Navigating Financial Recovery: The Power of Debt Adjustment Service Plans

In times of financial distress, finding a way to manage overwhelming debt can feel like an insurmountable challenge. However, amidst the stress and uncertainty, debt adjustment service plans emerge as a beacon of hope, offering individuals a structured path towards regaining control of their finances. Let’s explore how these plans work and the benefits they offer to those burdened by debt.

### Understanding Debt Adjustment Service Plans

Debt adjustment service plans, also known as debt settlement or debt negotiation programs, are structured arrangements designed to help individuals manage and reduce their debt burden. These plans typically involve negotiating with creditors to settle debts for less than the full amount owed, often through a lump-sum payment or structured repayment plan.

### How Debt Adjustment Service Plans Work

1. **Financial Assessment**: The journey begins with a comprehensive financial assessment conducted by a debt adjustment service provider. During this assessment, your income, expenses, and debts are evaluated to determine the best course of action.

2. **Negotiation with Creditors**: Once armed with a clear understanding of your financial situation, the service provider initiates negotiations with your creditors on your behalf. The goal is to reach mutually agreeable settlements that alleviate the burden of debt while satisfying creditors’ requirements.

3. **Structured Repayment**: Depending on the negotiated terms, you may be required to make a lump-sum payment to settle the debt or enter into a structured repayment plan. This plan typically involves making monthly payments towards the settled amount until the debt is fully satisfied.

4. **Cessation of Collection Activity**: As negotiations progress, creditors may agree to halt collection efforts, such as harassing phone calls and collection letters, providing relief from the stress of constant creditor contact.

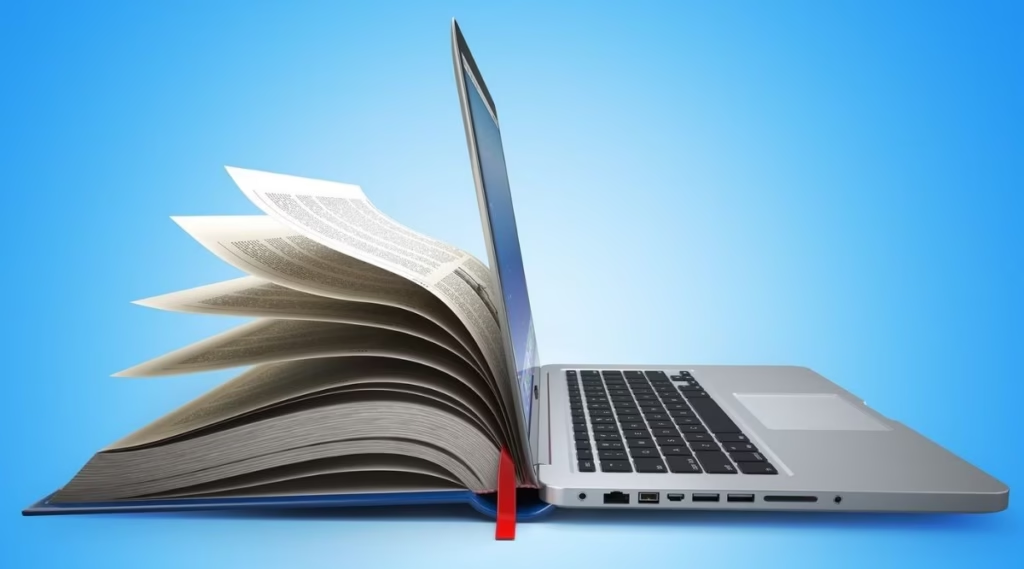

5. **Financial Education**: In addition to debt negotiation, many debt adjustment service plans offer financial education and counseling to help individuals develop budgeting skills, improve financial literacy, and avoid future debt problems.

### Benefits of Debt Adjustment Service Plans

1. **Debt Reduction**: One of the primary benefits of debt adjustment service plans is the potential for significant debt reduction. By negotiating with creditors, individuals may be able to settle their debts for less than the full amount owed, helping to alleviate financial strain.

2. **Simplified Repayment**: Debt adjustment service plans consolidate multiple debts into a single manageable payment, making it easier to track progress and stay on top of financial obligations.

3. **Financial Relief**: Negotiated settlements and structured repayment plans provide immediate relief from the burden of overwhelming debt, allowing individuals to regain control of their finances and move towards a brighter financial future.

4. **Professional Guidance**: Debt adjustment service providers offer expertise and guidance throughout the debt negotiation process, helping individuals navigate complex financial situations with confidence.

5. **Path to Financial Freedom**: By addressing debt head-on and implementing effective debt management strategies, debt adjustment service plans pave the way for long-term financial stability and freedom.

### Is a Debt Adjustment Service Plan Right for You?

While debt adjustment service plans offer numerous benefits, they may not be suitable for everyone. It’s essential to carefully consider your financial situation, weigh the pros and cons of debt adjustment, and explore alternative options before making a decision.

In conclusion, debt adjustment service plans offer a structured and effective approach to managing overwhelming debt and regaining financial control. With the support of knowledgeable professionals and a commitment to financial empowerment, individuals can embark on a journey towards a debt-free future, one step at a time.